Asset allocation is a critical component of successful investing. It serves as the backbone of your financial strategy, enhancing return potential while lowering risk. Most financial professionals agree that although particular investment decisions are crucial, asset allocation accounts for the bulk of the difference between a well-performing and a poor-performing portfolio. If you’re investing or thinking about it, understanding the basics of asset allocation is essential.

What is Asset Allocation?

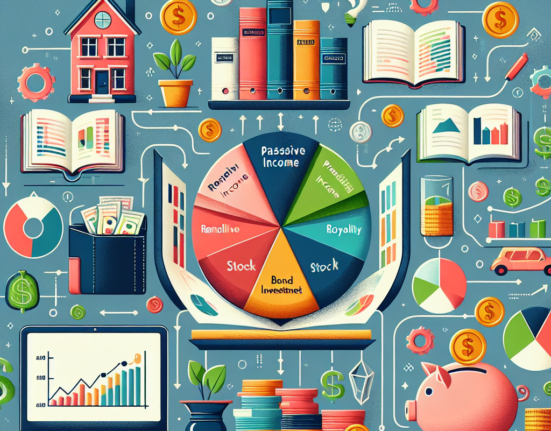

Asset allocation refers to the practice of dividing your investments across various asset categories, such as stocks, bonds, cash, real estate, and other investment vehicles. The fundamental idea is to reduce risk by investing in different areas that would each react differently to the same event.

The Importance of Asset Allocation

To understand the importance of asset allocation, consider this, markets fluctuate. Sometimes stocks soar, sometimes bonds outperform, and sometimes neither do well. Allocating your assets can mitigate these ups and downs.

Moreover, the right allocation can set you up for long-term financial success. By establishing a diversified portfolio, you ensure that you’re in the best position to endure market volatility and reap the rewards of market gains over time.

Key Components of Asset Allocation

- Risk Tolerance: Your risk tolerance is an essential factor in deciding the right asset allocation for you. It refers to the degree of variance in investment returns you are willing to withstand.

- Time Horizon: Your investment time horizon – the expected number of months, years, or decades you will be investing to achieve a particular financial goal – also impacts your asset allocation.

- Investment Objectives: The investment goals you are striving to achieve will influence the assets you choose and the proportion of your portfolio they comprise.

Creating Your Asset Allocation Strategy

Before embarking on creating your asset allocation strategy, you must understand your financial goals. Are you saving for a down payment on a house? A dream vacation? Your retirement? The more clarity you have on your financial goals, the more specific and realistic you can be in your asset allocation strategy.

Once you have identified your financial goals, consider your risk tolerance. If you’re young and have a higher risk tolerance, you might lean towards more aggressive investments. If you’re closer to retirement and want to protect your wealth, you might lean towards more conservative investments.

Then, review your time frame. The longer your time horizon, the more risk you can afford to take. Consider a 25-year-old who is just beginning to invest for retirement. Even if the stock market were to drop substantially, they have decades to recover these losses.

Review and Rebalance Regularly

Asset allocation is an ongoing process that needs regular review. Over time, market performance might cause your portfolio to shift from the original asset allocation. Therefore, you need to rebalance your portfolio from time to time.

Conclusion

In conclusion, asset allocation is a crucial strategy in investment. It involves diversifying your investments into various asset categories to reduce risk and optimize returns. It would be best if you considered your risk tolerance, investment objectives, and time horizon when deciding on an asset allocation strategy. Regular review and rebalancing are necessary to maintain the chosen asset allocation.

Frequently Asked Questions

- 1. Why is asset allocation important?

- Asset allocation is vital because it provides a balanced portfolio that can endure market volatility. It also potentially increases your chances of achieving your long-term financial goals by mitigating risk and enhancing return potential.

- 2. What factors should I consider when deciding on my asset allocation?

- Your risk tolerance, investment objectives, and time horizon are crucial factors to consider when deciding your asset allocation.

- 3. How often should I review and adjust my asset allocation?

- Most financial experts recommend reviewing your asset allocation annually or whenever there are significant changes in your financial goals, risk tolerance, or time horizon.

- 4. Does asset allocation guarantee success in investment?

- No, asset allocation doesn’t guarantee success; it simply helps in mitigating risk and enhancing the potential for returns over time.

- 5. What does it mean to rebalance my portfolio?

- Rebalancing refers to the process of realigning the proportions of your portfolio to meet your targeted asset allocation. This often involves selling high-performing assets and buying more of the underperforming ones.